- Lucid Group’s share prices recently increased by over 4% to $2.49, driven by favorable U.S. tariffs.

- A 25% import tariff policy could benefit Lucid due to its Arizona-based production and local sourcing, unlike competitors relying on international components.

- Benchmark analyst Mickey Legg maintains a “Buy” rating with a $5 price target, contrasting with Bank of America’s John Murphy, who lowered his target to $1 due to cash flow concerns.

- Lucid reported a 58% increase in Q1 vehicle deliveries, reaching 3,109, and plans to ship 600 vehicles to Saudi Arabia for assembly, signaling global expansion.

- The upcoming launch of the Gravity SUV could be a pivotal moment for Lucid amidst market volatility.

- Financially, Lucid outperformed the S&P 500 recently, despite previous declines.

- Lucid is positioned as a disruptive force in the electric vehicle market, with potential for significant growth.

Against the sweeping landscape of global economics and emerging technologies, Lucid Group stands as both contender and cautionary tale in the electric vehicle arena. Recently, Lucid’s share prices leaped over 4% to $2.49, illuminating the potential favorability of newly imposed U.S. tariffs for this unconventional electric vehicle maker. Despite a tumultuous year with stocks down more than 20%, Lucid’s story is one of perseverance against the currents of a volatile market.

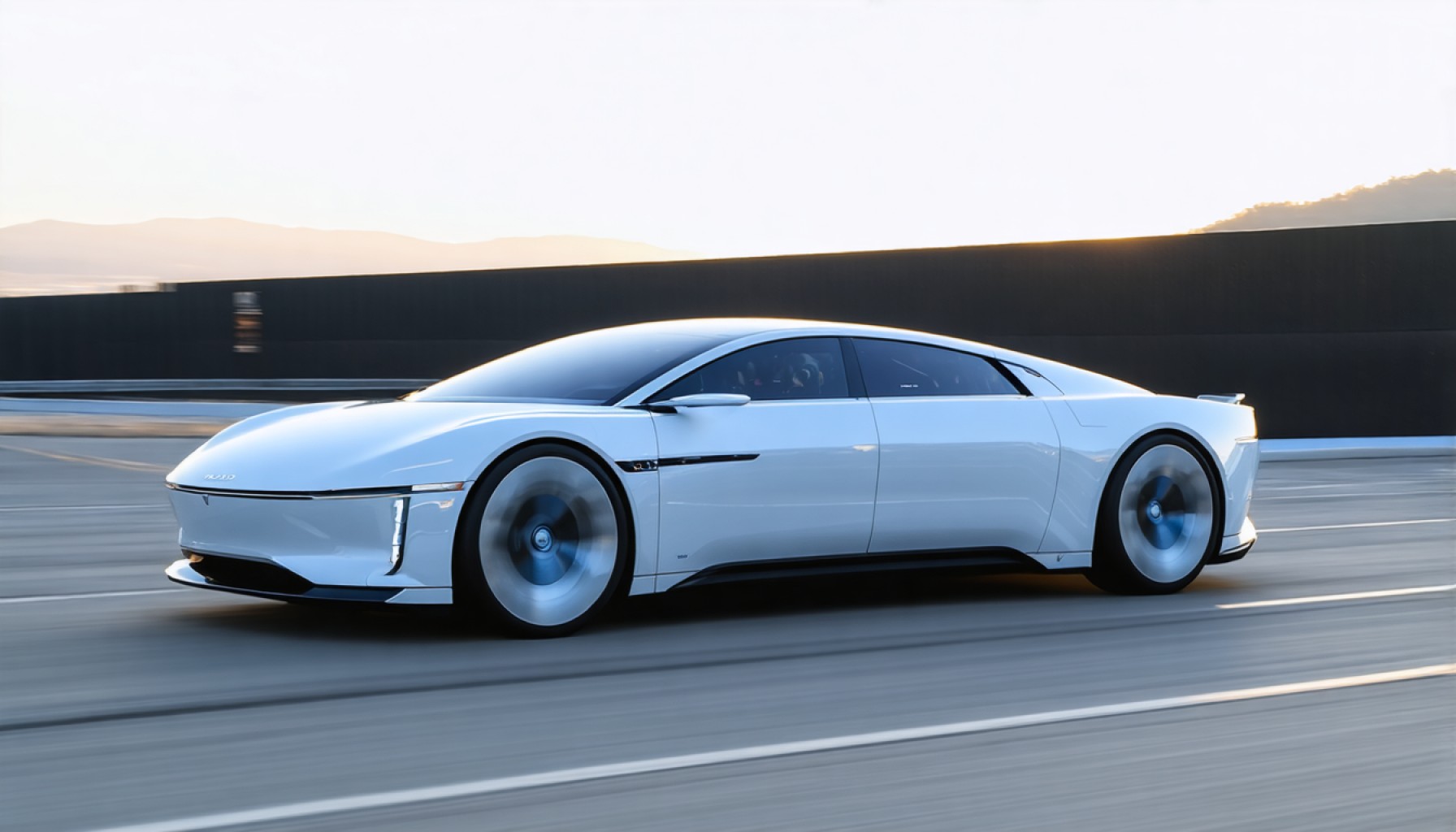

The backdrop? A controversial 25% import tariff from the Trump administration, shaking the auto industry’s giants to their core. Yet, for Lucid, this policy might be a quiet boon. With its sleek vehicles rolling out of Arizona and many components sourced proximally, Lucid is weaving a tapestry of resilience against an international tide, where competitors like BMW and Hyundai rely heavily on distant shores.

Benchmark analyst Mickey Legg seems keenly aware of Lucid’s potential to brave trade tempests, steadfast in his “Buy” rating. His $5 price target echoes the optimism that perhaps other analysts lack. Meanwhile, the company astonishes with a 58% increase in Q1 vehicle deliveries, totaling 3,109. Lucid also revealed plans to ship 600 vehicles to Saudi Arabia, destined for final assembly—a testament to its expanding global footprint.

And yet, amidst this promise, voices of concern rise. Bank of America Securities’ John Murphy isn’t easily swayed by the optimism, slashing his target to $1—a sobering reminder of Lucid’s battles with cash burn and its recent billion-dollar convertible note adventure. Intended to manage debts maturing in 2026, this move underscores an urgency to stabilize finances amidst ambitious growth.

As Lucid navigates these tumultuous seas, the upcoming launch of its Gravity SUV looms large, a potential inflection point in its pursuit of market maturity. Current tariff conditions may offer a lifeline, yet the path forward demands strategic foresight.

In the trenches of financial metrics, Lucid defies broader market trends, surpassing the S&P 500 with a recent 0.62% weekly rise and month-long climb of 13.26%. But recollections of a six-month plunge of 28.80% linger as cautionary markers, cautioning investors against unbridled optimism despite outperforming recent market downturns.

Lucid Motors embodies a classic underdog automaker narrative, challenging established norms and daring to redefine success in an electrifying industry. As global dynamics shift and policies evolve, so too does Lucid’s potential to not just survive, but thrive.

Lucid Motors: Navigating the Complex Terrain of Global Economics and EV Market

Understanding Lucid Motors’ Position in the Electric Vehicle Market

Lucid Motors is making headlines not just for its technological innovations but also for its strategic prowess amidst global economic changes. As a burgeoning electric vehicle (EV) manufacturer, Lucid is creating ripples in the industry with its enhanced production capabilities and strategic market maneuvers. The company’s recent stock surge, attributed to new U.S. tariffs, reflects the complex interaction of domestic policies and global economics affecting the EV market.

Strategic Advantages and Challenges

1. Import Tariffs as a Competitive Edge

The 25% import tariff imposed by the Trump administration was initially seen as detrimental to the auto industry. However, for Lucid Motors, it represents an unexpected advantage. Unlike giants such as BMW and Hyundai, who rely on international supply chains, Lucid’s operations are primarily based in Arizona. This proximity to component suppliers allows Lucid to mitigate the impact of these tariffs, potentially providing a price advantage in the U.S. market.

2. Robust Production and Global Expansion

Despite economic headwinds, Lucid reported a staggering 58% increase in Q1 vehicle deliveries, emphasizing its accelerating production growth. Additionally, its plan to export 600 vehicles to Saudi Arabia underscores its strategic international expansion. This move aligns with Saudi Arabia’s ambitious Vision 2030 plan to diversify the economy and increase sustainability initiatives.

Market Analysis: Prospects and Concerns

Optimism vs. Financial Concerns

Analysts like Mickey Legg express optimism, with a “Buy” rating and a price target of $5, highlighting the confidence in Lucid’s capability to withstand market volatility. Nonetheless, concerns persist. John Murphy of Bank of America Securities has underscored financial challenges by setting a conservative price target of $1. Lucid’s ongoing cash burn and significant debt ventures are critical issues that could hinder long-term sustainability unless addressed promptly.

Industry Trends and Market Forecasts

The global EV market is growing rapidly, driven by environmental concerns, customer demand for high-performance vehicles, and supportive government policies. According to Statista, EV sales are projected to reach 40 million units annually by 2030. Lucid’s innovative vehicles like the upcoming Gravity SUV could capture significant market share if they continue to emphasize quality and performance while managing costs effectively.

Best Practices for Potential Lucid Investors

1. Diversify Investments: While Lucid presents an enticing growth prospect, diversification is paramount given the inherent risks.

2. Monitor Financial Health: Keep a close watch on the company’s financial reports, particularly cash flow statements, and debt management strategies.

3. Stay Informed on Policy Changes: Keep abreast of U.S. trade policies and global market access developments which could impact Lucid’s operations positively or negatively.

4. Evaluate Market Trends: Understanding the broader trends in EV adoption rates and technological advancements can provide deeper insight into Lucid’s potential trajectory.

Quick Tips for EV Enthusiasts

– Sustainability Check: Consider the environmental impact of vehicle production beyond emissions. Lucid’s commitment to locally sourced components may be a positive step.

– Performance Metrics: When considering EVs, evaluate battery life, charge time, and performance benchmarks, areas where Lucid excels.

Conclusion

Lucid Motors is at a pivotal crossroads with substantial opportunities and notable risks. By keeping eyes on both the micro economics of their operations and the macro trends of the global market, investors and enthusiasts can navigate this landscape more confidently. For further insights and updates on the electric vehicle industry, explore authoritative resources like Autoblog for automotive news and trends.